United Bank Of India Rupay Platinum Debit Card Charges

Rupay emv652171 visa emv 462488 rupay platinum 652193 rupay mudra emv608163 united wallet prepaid card 508846 enabled at.

United bank of india rupay platinum debit card charges. Rupay emv card. United visa emv debit card is a basic card for all our customers willing to avail the debit card services at their ease for transactions. Card hotlisting lost card reporting. Cash withdrawal of rs 25000 maximum from the atms.

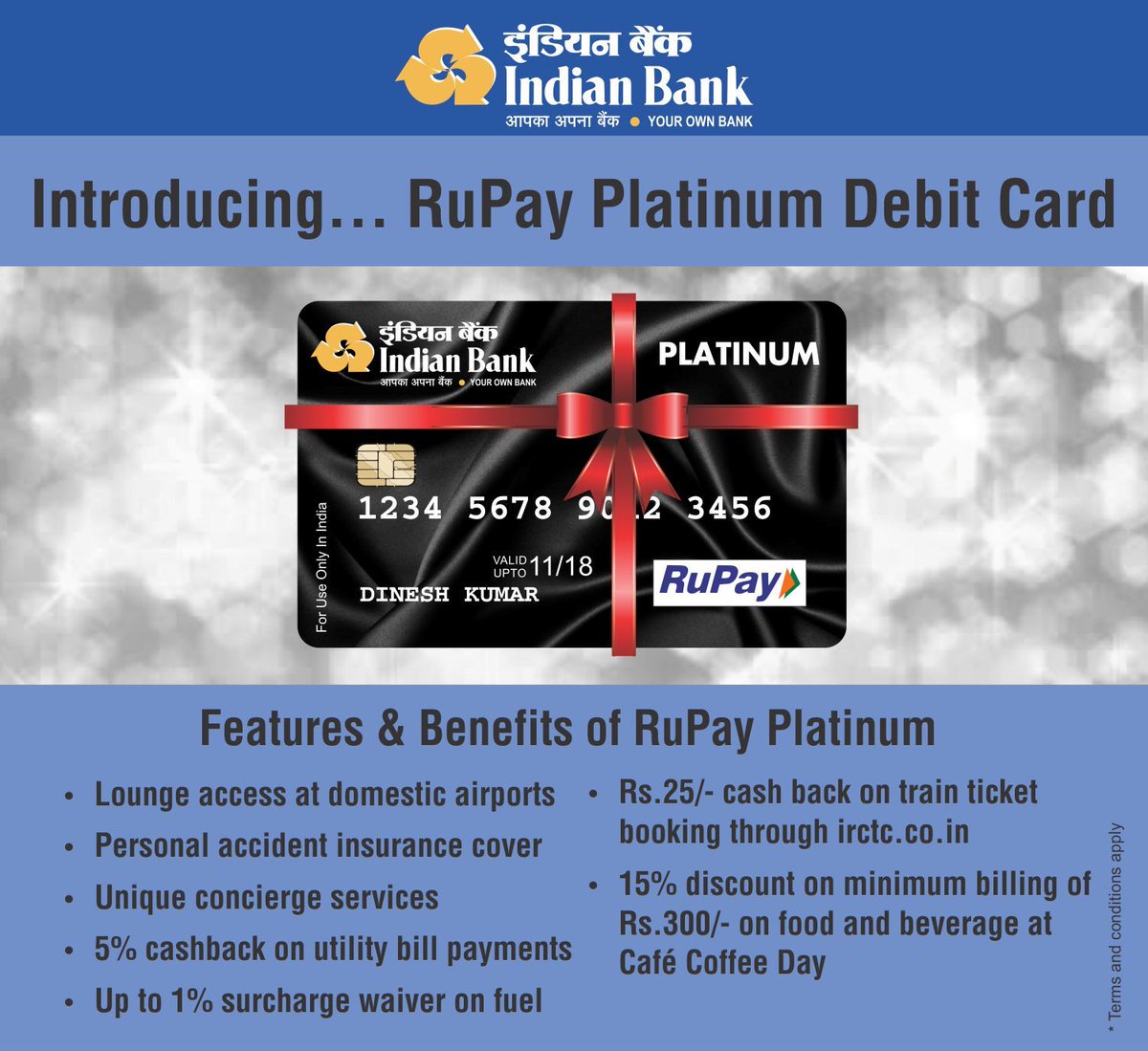

Maximum of 5 transaction including cash withdrawal and pos can be performed. Enjoy the prime facilities with our union bank platinum debit card and become part of digital economy. Rupay platinum debit card with usage limit of rs50000 in atm and rs100000 in point of sales personal accident insurance cover of 2 lakhs for ib surabhi product details click here. Rupay platinum emv card.

2 with rupay platinum debit card. A nominal fee of rs 200 plus service tax will be charged towards card issuance. Eligibility customers with savings current overdraft having used want to use their card at international location. United rupay kisan debit card is launched for issuance to kcc account holders of the bank.

United bank platinum emv debit card can be used in. Rupay kisan debit card. It is a first indian card which is rupay based and driven by national payment corporation of india. Rupay debit card.

100000 for visa daily cash withdrawal limit atm. Shopping of rs 40000 maximum at stores through pos terminals. The card may also be issued to our esteem customers on demand. United rupay debit card is a debit card for domestic usage by the customers.

Maximum of 5 transactions. Visa debit card. Shopping maximum of rs 40000 at stores through pos terminals and online shopping by e com transaction. Cash withdrawal of rs 25000 maximum from the atms.

Cash withdrawal of rs 100000 maximum from atms. All visa member banks atms pos and e com in india. Avail airport lounge facility twice in a quarter with a spend of only rs. All nfs member banks atms.

Average quarterly balance average quarterly balance. Shopping shop online or at retails stores through pos terminals for a maximum of rs25000 daily. Cash withdrawal of rs 75000 maximum from the atms.