Handle Customers Bank Transactions

Is a direct visa.

Handle customers bank transactions. How to handle downloaded bank transactions in quickbooks online. This is because ach transactions are not actually handled by the bank. Bank tellers must possess excellent basic mathcounting skills as well as exceptional people skills. Investigating fraud is a complex process.

This waste took a toll on the banks cost to income ratio and ultimately on profits as well as on both customer and employee advocacy. Through a combination of initiatives ranging from simplifying online forms and printing formats. This is where our difference can be most notably experienced finding solutions to complex situations and delivering results quickly and. Our staff is dedicated to delivering our merchants unparalleled service with a personalized agent always available to handle any issues.

You would think that bank transaction software would allow a bank to cancel ach credits and debits but if both parties do not agree to end the transaction then it will continue. We are committed to providing a high level of service for our customers. If the customer is still unhappy do your best to treat them in the same way youd treat a happy customer. How do banks investigate unauthorized transactions.

Several different types of banking transactions can take place in person by telephone or online. Major highlights of this application. One way to handle customers is to let any mean or rude comments slide without responding to them since theyre likely just reacting in the heat of the moment. However most of a tellers training is done once they are hired by a bank.

While our intention in providing links is to guide you to information or an opportunity from a customers bank affiliate a government agency or other known and valued source we are required to inform you that customers bank is not liable for any failure of products or services offered on. But what happens next. Quickbooks does help a whole lot in that it will recognize past transactions or transactions such as checks or customer payments. Uses proper data structure to hold these accounts.

An authorization letter for bank can be given by the signatory of a bank account to authorize a person to a third party to conduct transactions on their behalf. A bank teller is responsible for the day to day financial transactions that customers of a bank need to take care of. Instead they are handled by the clearing. So here we have provided you with different templates of letter of authorization for bank downloadable in pdf format.

For example you can pretend you didnt realize their comment was rude or mean and just continue on with the conversation. Instead it keeps them in a separate area for you to review and add directly to the register. Training can begin before being hired. These can also be used as a reference for writing your own letter of authorization.

Heres what e commerce merchants need to know about the process. The bank reckoned that its customers and employees were spending 5 billion minutes per year at branches with the vast bulk of that time on the customers end. Quickbooks does not automatically input the downloaded transactions into your quickbooks bank register. After the initial shock the first thing most customers do is call their bank to report the fraud.

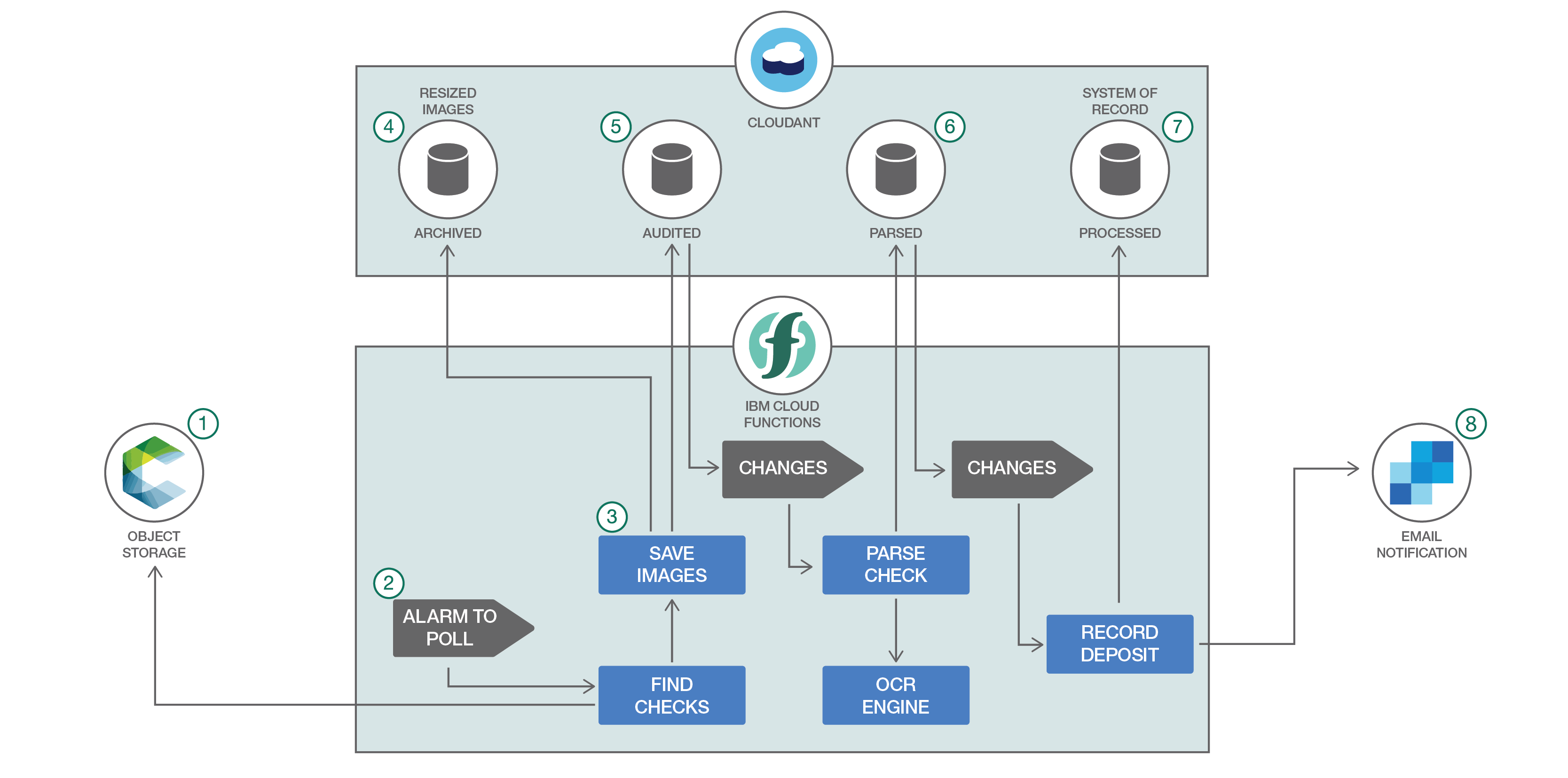

Its never good news when a customer finds out there has been an unauthorized transaction on their credit card. Both savings and current accounts. An application to handle customer bank account and perform transactions.