Digital Transformation For Banks

Companies that fail to adapt can quickly be left behind.

Digital transformation for banks. Established banks are challenged by new agile players. In a digital driven bank or credit union digital is treated as a priority that needs a clearly articulated strategy funding talent agile ways of working and an organizational culture that is willing to take risks. Reinvent for new value. To stay ahead executives know they need digital transformation.

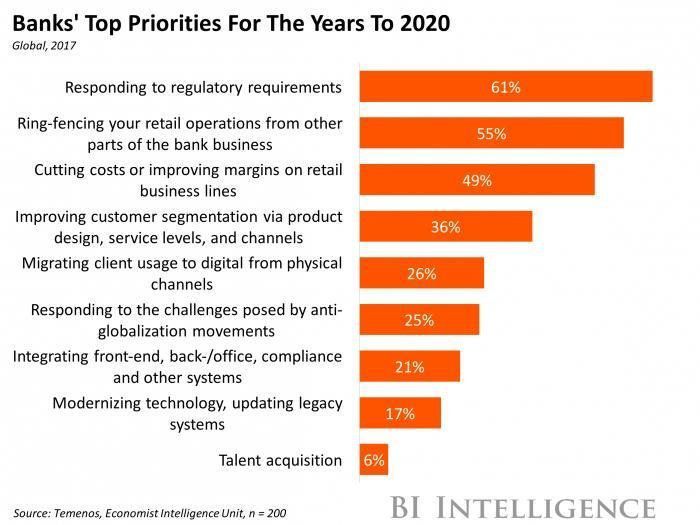

Pursuing a digital transformation is the critical path for banks to boost roe. Britain has long been recognised as one of the most innovative and fast moving fintech sectors in europe. At the same time they must manage the risks created by the new digital economy. Fintech firms online banks and non financial platform companies are edging into retail banking causing banks to focus.

The digital transformation of any enterprise is a herculean task requiring a willingness to embrace cultural change the ability to immerse the entire organization in the customer journey and a total commitment to digitize to the core. Banks are racing to take advantage of market opportunities available through digital transformation. But change isnt easy. An efficacious digital transformation begins with an understanding of digital customer behavior preferences choices likes dislikes stated as well as unstated needs aspirations etc.

The four pillars of digital transformation in banking. Thats not easy to accomplish but can be well worth the effort. In addition digital transformation brings about fundamental changes in working modes and business models of the financial sector. Digital transformation by year 2021 3 billion people are expected to use digital banking channels in some form or the other.

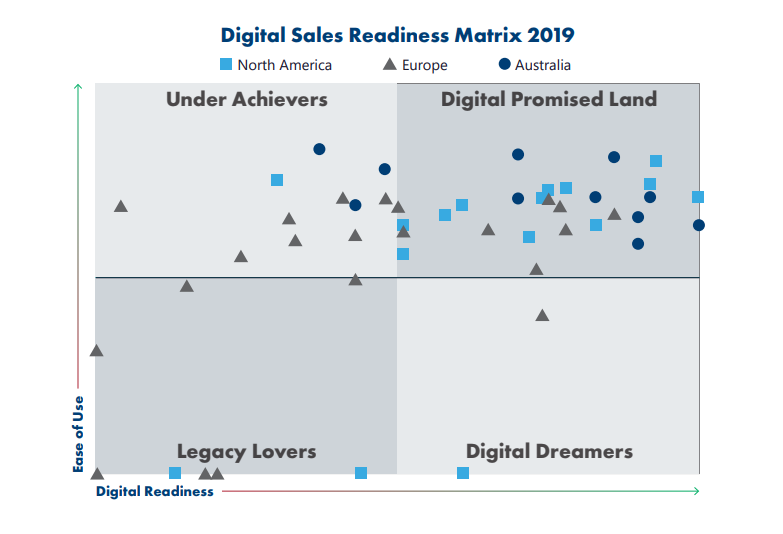

Those can be your customers too but the question is are you ready. And this transformation leads to the major changes in the organizations from product. Dbs bank chief information officer david gledhill shares his insights on dbss digital transformation with mckinseys vinayak hv a partner in the. As a central bank with a mandate to ensure price stability it is important that we are able to gauge such developments and anticipate possible repercussions.

There is a critical need for affordable computing platforms that provide greater agility. Our survey shows that 87 percent have a formal long term plan for digital innovation. If youre interested in how to help banks drive digital transformation with cloud based analytics please read my previous blog post here. Ibm digital reinvention helps your business to exceed customer expectations drive new revenue opportunities and adopt fearless experimentation.

There is no doubt new digital technologies are changing the banking. It is a vital change in how banks and other financial institutions learn about interact with and satisfy customers. Banks need to remain digital leaders. Banking the rising popularity of uk bank transfers.

Banks and credit unions that digitize can achieve a 20. But pwcs george hodges banking fintech lead and justin oconnor digital banking lead both agree theres really only one way forward and thats through a digital transformation. For banks digital transformation isnt just about improving efficiency or controlling costs. Learn more on how 01 systems can help you with banking solutions that you can rely on in your digital transformation journey.

Technology underpins the creation of the.