Challenger Banks In Us

Generating revenue beyond interchange fees is a challenge for most players.

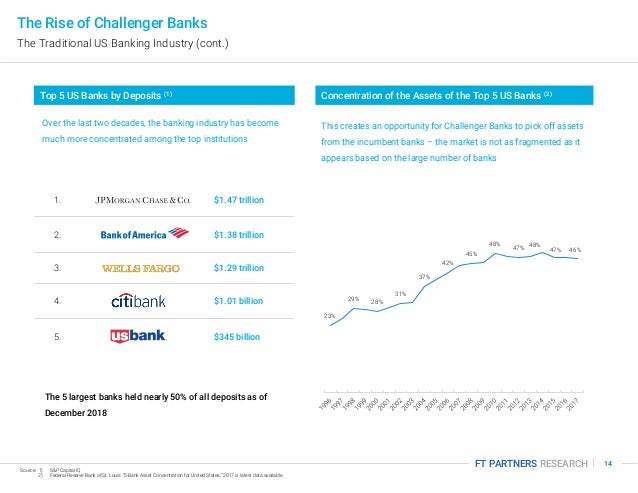

Challenger banks in us. Bankmobile is another us based challenger bank. Challenger banks have become a software as a service industry with a freemium component. By newer we mean that most challenger banks were founded after 2009 so after the 2008 global financial crisis and the vast majority began after 2014. As challenger banks seek to enter the us the business model still faces hurdles.

Browse the independents complete collection of articles and commentary on challenger banks. Sep 16 2017 923am. All the latest breaking news on challenger banks. When the 2008 financial crisis shattered public trust in banking institutions the worlds most innovative financial entrepreneurs saw an opportunity.

Challenger banks have nearly doubled their share of the retail lending market including mortgages and unsecured loans in three years from 4 per cent in 2010 to 7 per cent in 2013 according to. For example revolut offers premium accounts for 799 per month with higher limits some insurance. They are one of the only challengers to allow customers to exchange money into cryptocurrencies and you can earn cashback with any purchase made on their metal card. Banking had long been open to only a few players but the political fallout from the crisis combined with new technological developments made it easier than ever for competitors.

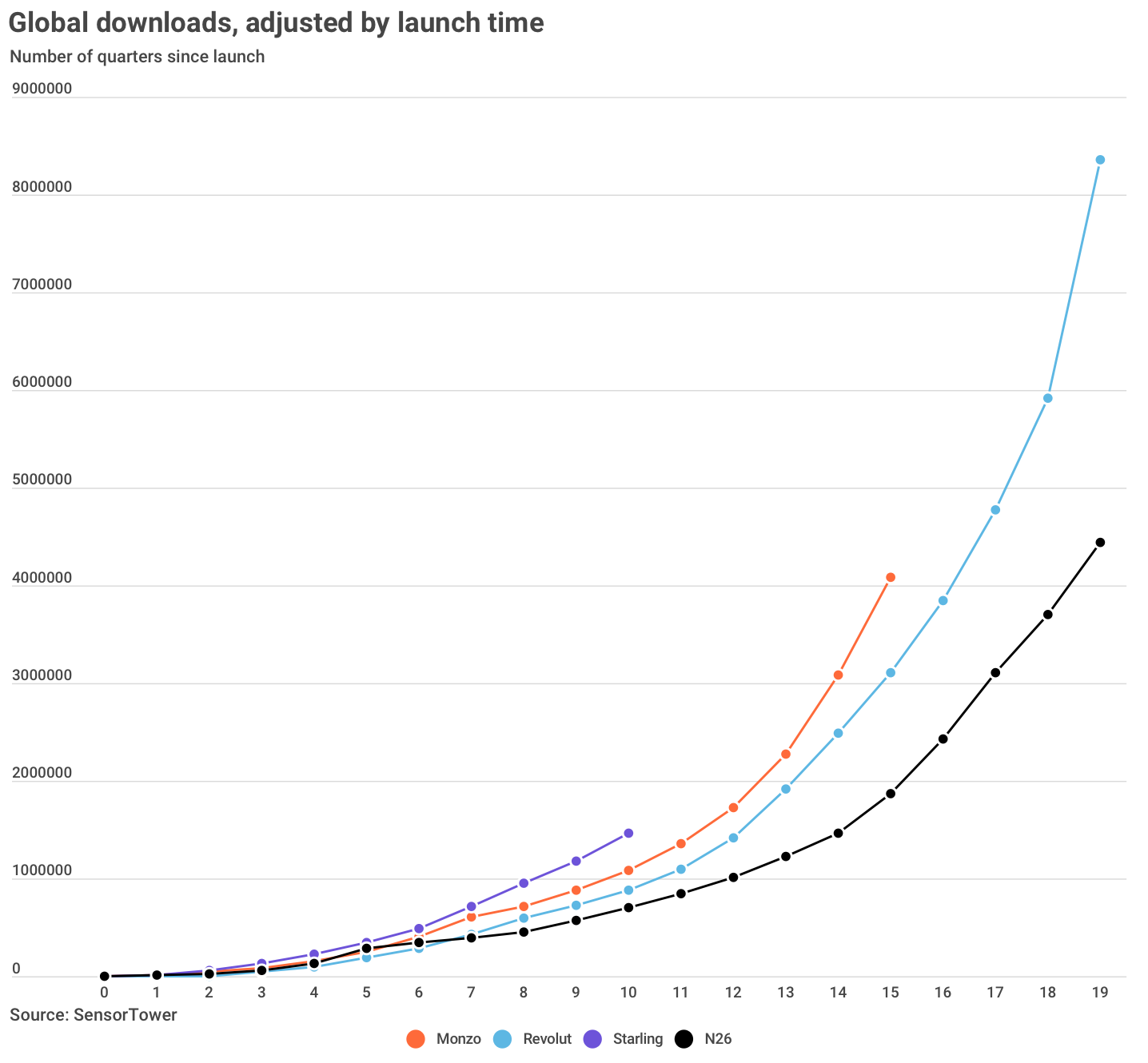

2018 may be the year startup banks make inroads into the us. Founded under parent company customers bank in 2015 the firm was acquired by flagship community bank this year. Launched back in 2015 revolut is one of the largest challenger banks in the market. A challenger bank is one thats smaller and newer than a traditional bank.

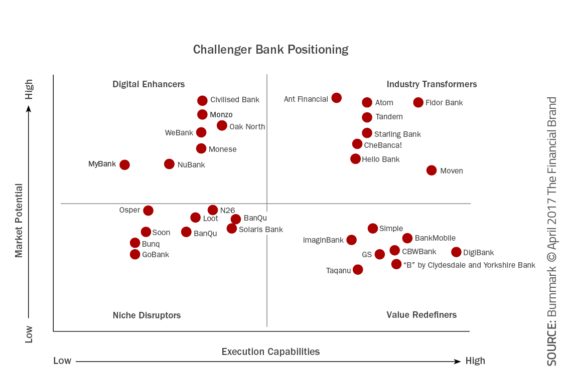

The company provides a wide range of products and services including checking and savings accounts personal lines of credit loans and personal bankers. A challenger bank from germany now working on its us presence including obtaining a banking licence. It opened early access to users in the us in october 2017 and has an office in new york with eight staff.