Beneficiary Bank Account

The persons designated as beneficiaries may differ from those who receive under the will.

Beneficiary bank account. A beneficiary designation however is different. Instead of sharing the account with another account holder setting up a this kind of designation is a form of estate planning that allows an account holder to leave a bank accounts contents to a. In this situation both people have access to the funds in the account. A bank account beneficiary designation can pass the contents of a bank account separately from the rest of that persons estate.

Naming a beneficiary for a bank account can be an effective way to ensure that your beneficiary receives money when you die without having to go through probate first. When you leave money to someone in this manner the beneficiary may or may not have to pay taxes on the inheritance. How to add a beneficiary for a bank account you can keep your bank account out of probate by adding a pay on death or pod beneficiary to the account. The pod is also known as a transfer on death or tod account also called a totten trust.

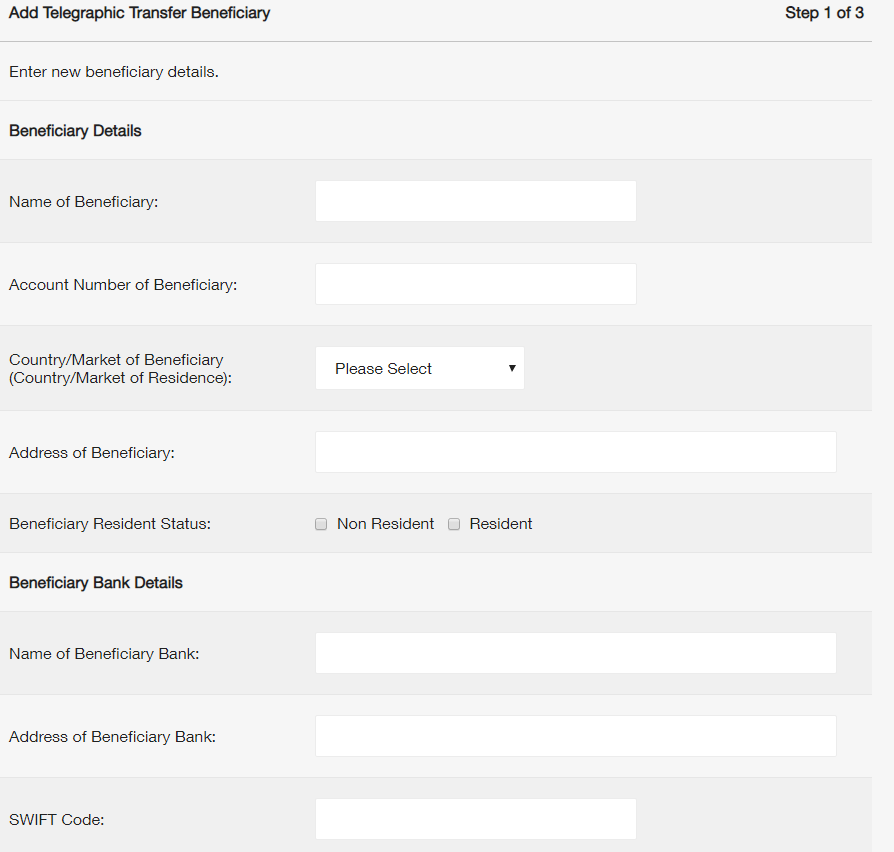

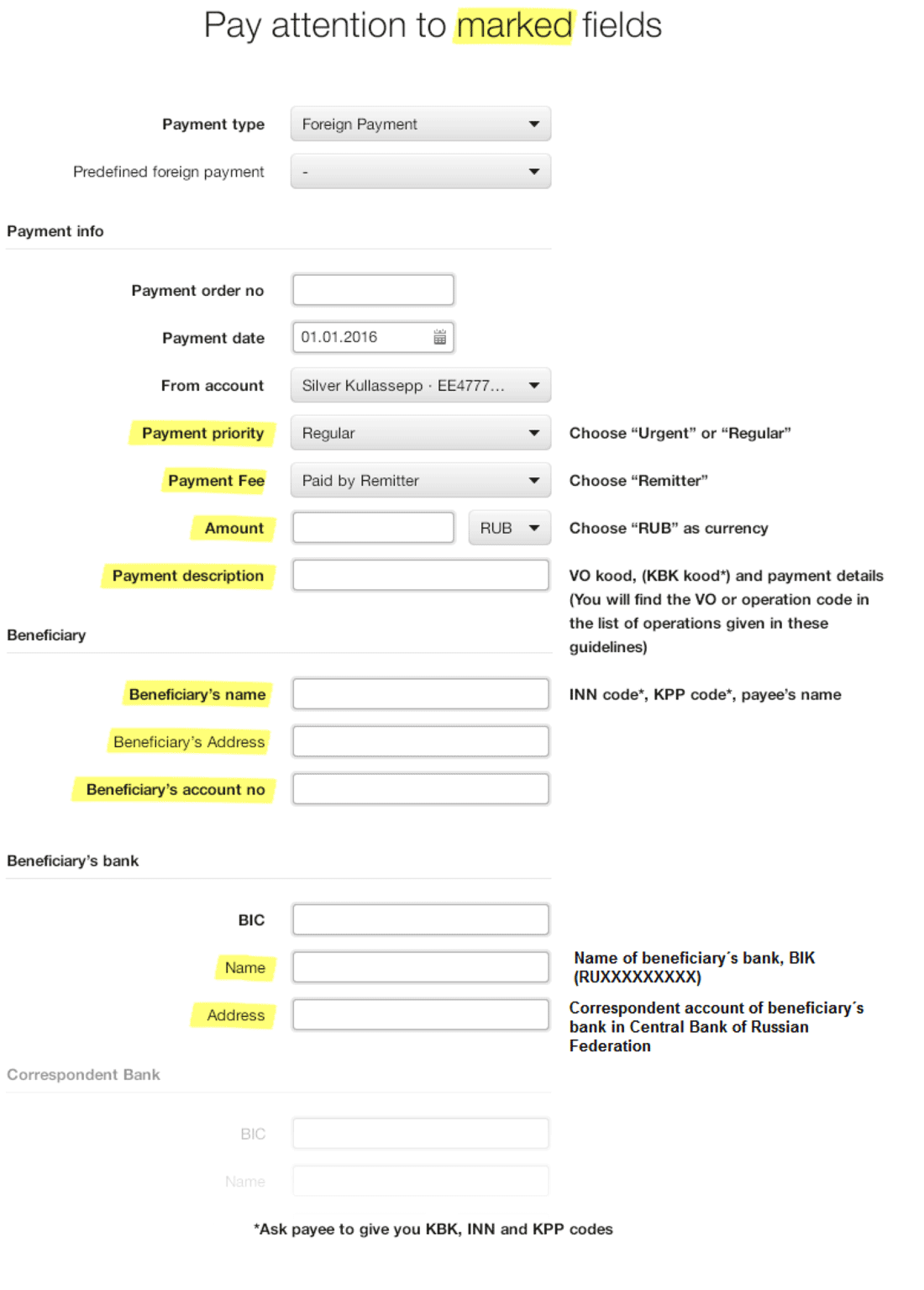

Most people know they can have a bank account with more than one signer. For instance a bank account holder may make one child the accounts beneficiary while the will indicates that the estate is to be divided equally between him and the other. If somethings missing the beneficiary bank charges additional third party costs since this type of payment prevents fully automated processing.