Bank Reconciliation Statement Journal Entries

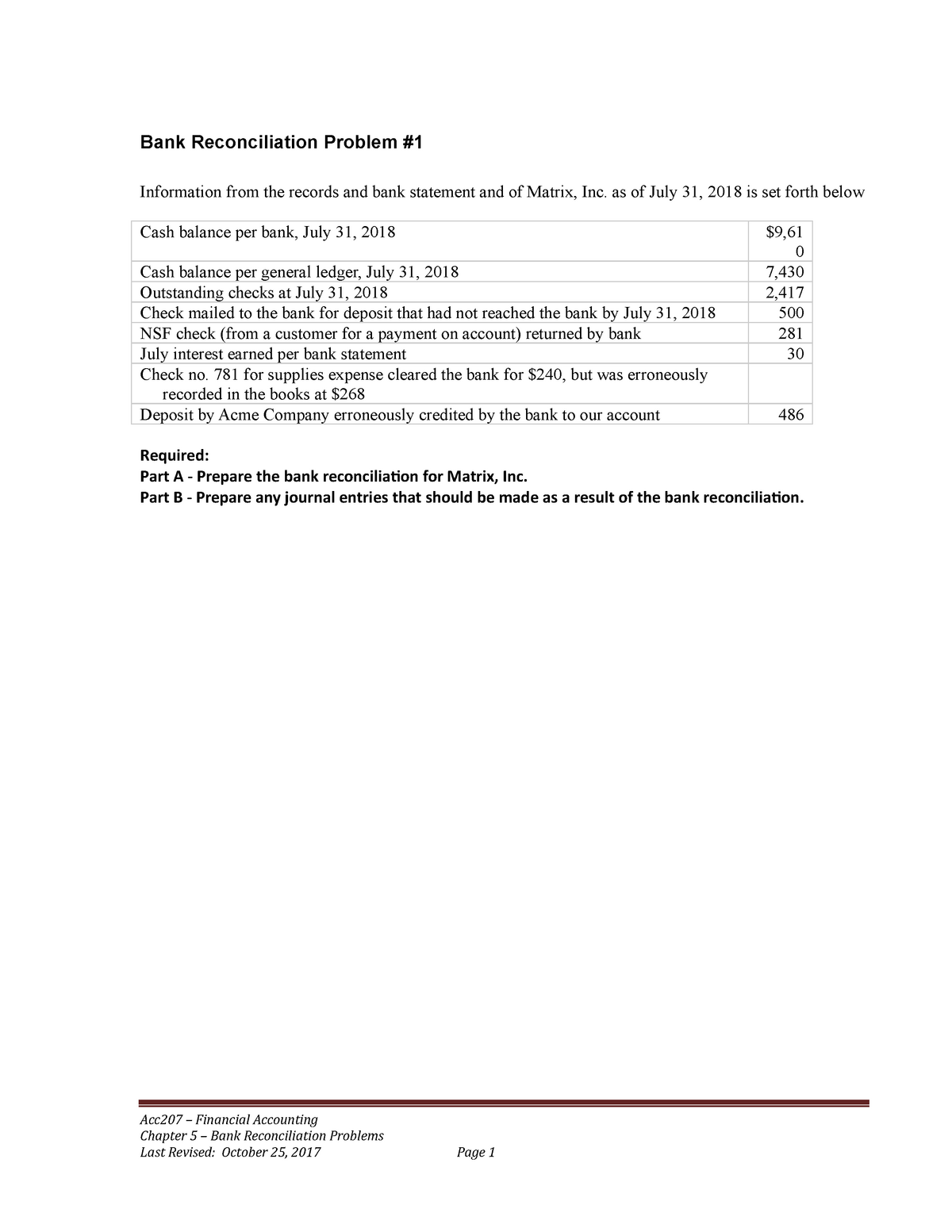

For better explanation and understanding consider the following example.

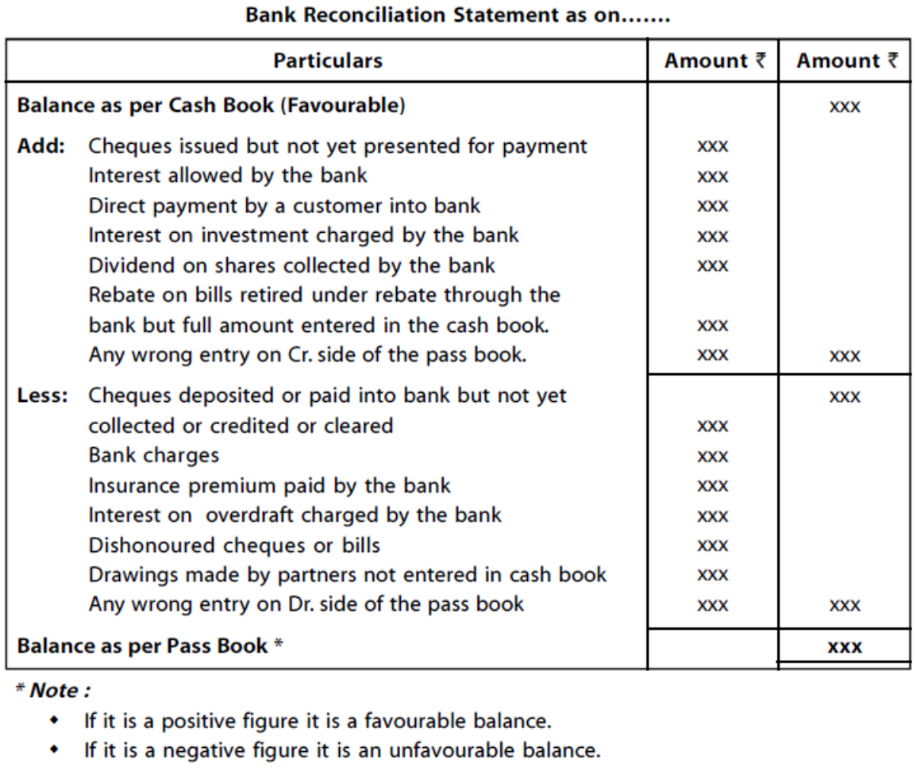

Bank reconciliation statement journal entries. The bank reconciliation journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting relating to bank reconciliation adjustments. Subscribe subscribed unsubscribe 467. Learn how to journalize the entries required at the end of a bank reconciliation. After recording the journal entries for the companys book adjustments a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month.

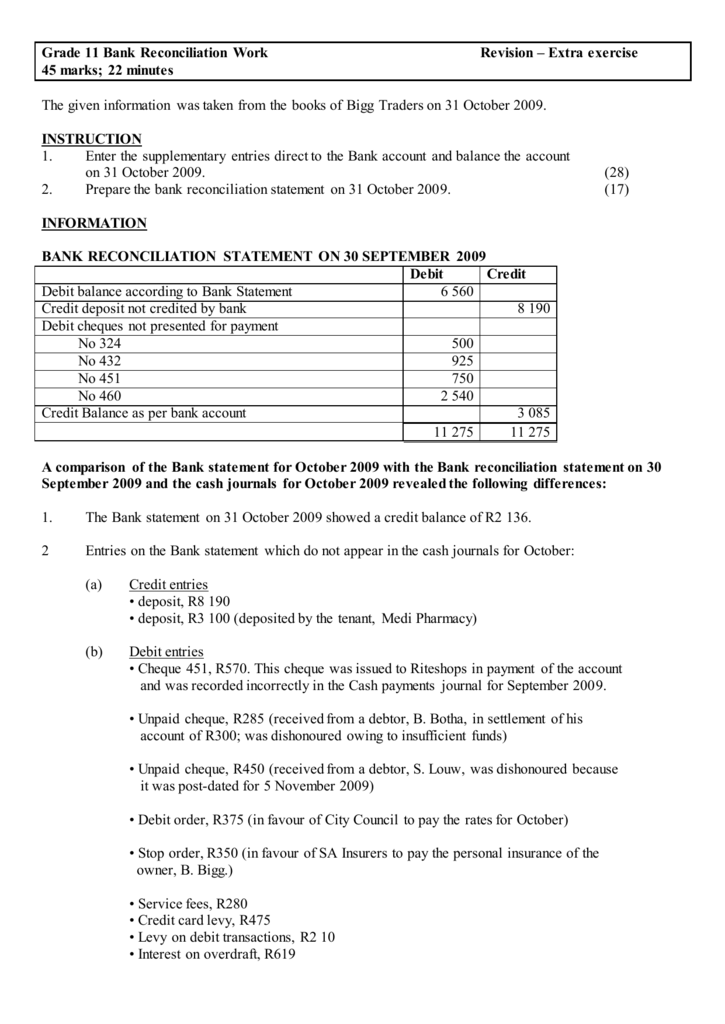

Download the free template. The bank statement of the fast company shows a balance of 10000 on 31 january 2015 whereas the companys. Examples of journal entries for bank reconciliation. A brs means matching records.

Bank statement reconciliation and journal entries cheri bergeron. The final step in a bank reconciliation is to prepare appropriate journal entries for the items that you have not recorded yet in your accounting records. Click here to see the original bank reconciliation video. Great tools happy people.

In this part we will provide you with a sample bank reconciliation including the required journal entries. We will assume that a company has the following items. A brs checks entries on a monthly basis to avoid any future discrepancy. Unsubscribe from cheri bergeron.

Bank service charges which are often shown on the last day of the bank statement. Bank reconciliation statement is a statement which records differences between the bank statement and general ledger. Sample bank reconciliation with amounts. Since the service charge is on the bank statement but not yet on the companys books a journal entry is needed to credit cash and to debit an expense such as bank.

In each case the bank reconciliation journal entries show the debit and credit account together with a brief narrative. Enter your name and email in the form below and download the free. The amount specified in the bank statement issued by the bank and the amount recorded in the organizations accounting book maintained by chartered accountant might differ. Examples of items requiring a journal entry as the result of the bank reconciliation include.

This statement is used by auditors to perform the companys year end auditing. On august 31 the bank statement shows charges of 35 for the service charge for maintaining the checking.