Bank Money Order

Money orders and bank drafts are payment orders for pre determined amount of money.

Bank money order. Money orders are a simple way to send someone money without needing a checking account. When you purchase a bank money order you pay in advance the funds backing the payment. Information displayed on a. Since money orders require you to pay in advance the money isnt tied to any bank account and can be sent to other people.

However while the money order is a guarantee to the recipient that the funds are available the purchaser may not have an easy way to find out whether the money order was received and. If its signed by the bank but drawn on an account maintained by thebank at another institution it is the legal equivalent of a tellers check. This way the personbusiness receiving payment wont have problems. Both money orders and bank drafts are used to pay money to a third party.

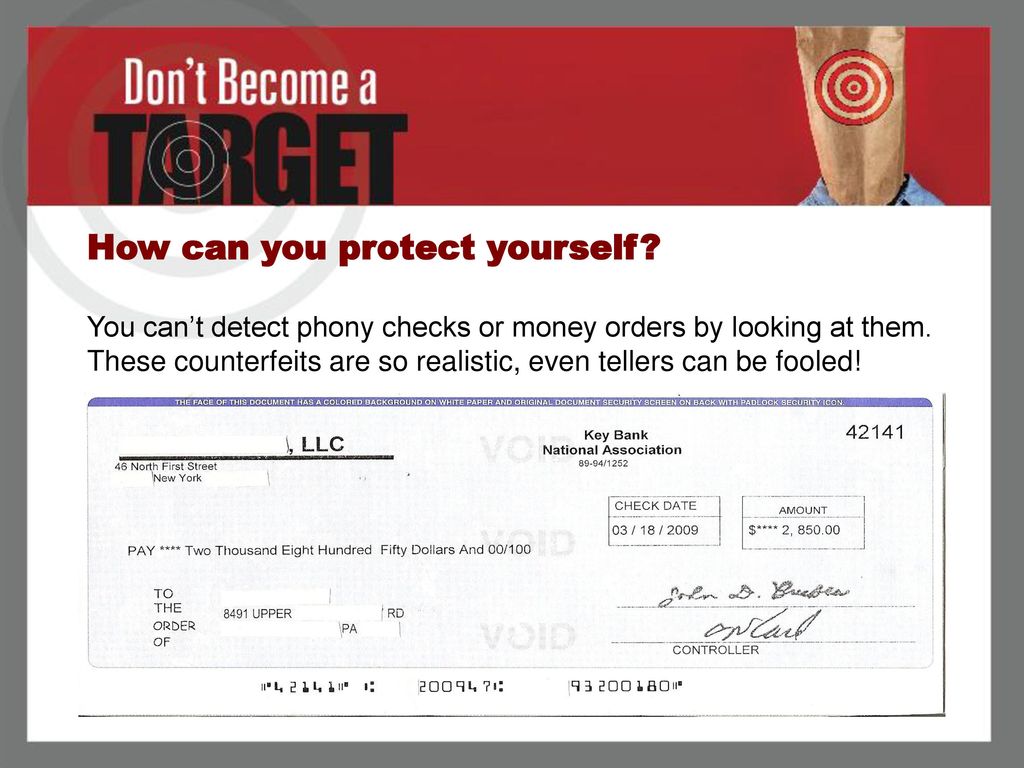

Bank drafts and money orders are more secure way of payment compared to personal or business cheques because they require that the amount specified on them is pre paid. You can get cash later if necessary and in the meantime your funds will be safe in the bank. Because you prepay the funds bank money orders are more secure than personal checks for making payments. If you dont have an account at a bank.

A bank money order is a type of payment issued by a banking institution for a pre determined amount. A money order is a certificate usually issued by governments and banking institutions that allows the stated payee to receive cash on demand. Regular money orders can be bought at your local grocery store bank or post office. One of nerdwallets best prepaid debit cards for.

Abank should generally not put stop payments on these. Since money orders and cashier checks are prepaid the funds are considered guaranteed forms of payment. How to track a money order from a us. A bank money order is signed by thebank and is therefore a direct bank obligation.

Cashiers checks or tellers checks are other terms for bank money orders. So if you need to send 5000 just purchase five money orders worth a grand apiece. Use your existing checking or savings account and transfer the money elsewhere if you have other uses for it. There are some limitations to paper money orders but theyre easily worked around.

If you dont need 100 of the money order in cash its probably a better idea to deposit the money order in your bank account rather than cashing it. If the money order is signed bythe bank and drawn on the bank it is the legal equivalent of a cashierscheck. A money order functions much like a.

:max_bytes(150000):strip_icc()/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)