Bank Charges In Financial Statements

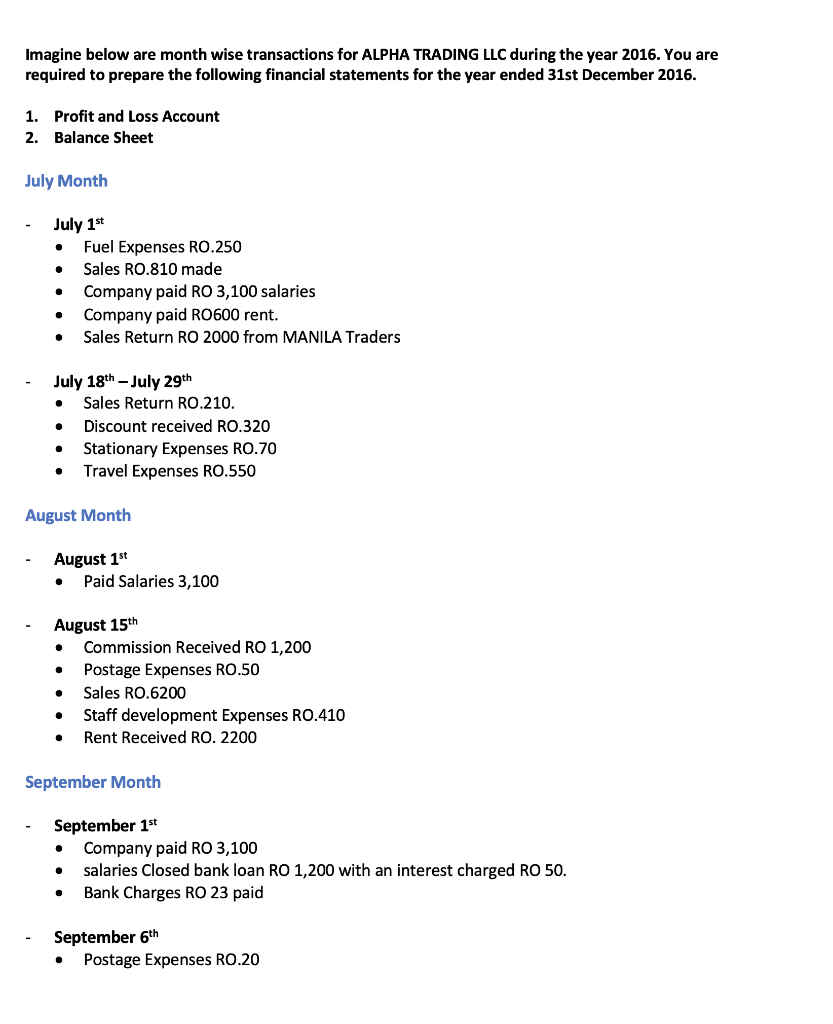

Murray decided not to increase his monthly forecasted bank charges expense during 200y.

Bank charges in financial statements. Bank charges can be a major source of income for a financial institution. If the bank charges are related to borrowings then it shall be classified as other borrowing costs under finance costs or else record as other expenses in case of normal banking operations. The difference needs to be eliminated by adjusting the cash book of the company before the preparation a bank reconciliation. These charges are usually not recorded by the business until the bank provides the bank statement at the end of a month which is why balance as per bank statement may be lower than the cash book balance.

As a result the 200y forecasted cash flow statement will show a cash outflow of 40 each month between january and december for bank charges. In the budgeted income statement example above we can see that the actual profit for the period is about 8500 less than what was planned for. Bank charges are charged directly to the customer account thereby reducing the bank balance shown in the bank statement. In this article youll get an overview of how to analyze a banks financial statements and the key areas of focus for investors who are looking to invest in bank stocks.

A business that incurs bank charges will usually record them as expenses as part of its monthly bank reconciliation process. This guide will teach you to perform financial statement analysis of the income statement balance sheet and cash flow statement including margins ratios growth liquiditiy leverage rates of return and profitability. Accordingly these illustrative financial statements should not be used as. Discover more about the term finance charge here.

In addition murrays 200y. The illustrative examples. Financial statements for banks. The manual handling of transactions by a bank teller.

Inactivity in an account. The issuance of a paper bank statement rather than an on line one. According to ias 23 borrowing costs include interest on bank overdrafts and borrowings finance charges on finance leases and exchang. A substitute for referring to the standards and interpretations themselves.

A finance charge is a fee charged for the use of credit or the extension of existing credit. While the general structure of financial statements analysis of financial statements how to perform analysis of financial statements. The even numbered pages contain explanatory comments and notes on the disclosure requirements of ifrs. This was due to the income being 5400 less 100000 94600 and the expenses such as water and electricity being greater than expected.