Bank Balance Sheet Assets And Liabilities

Learn how to read a balance sheet or more importantly how to read between the lines of the balance sheet assets liabilities and equity.

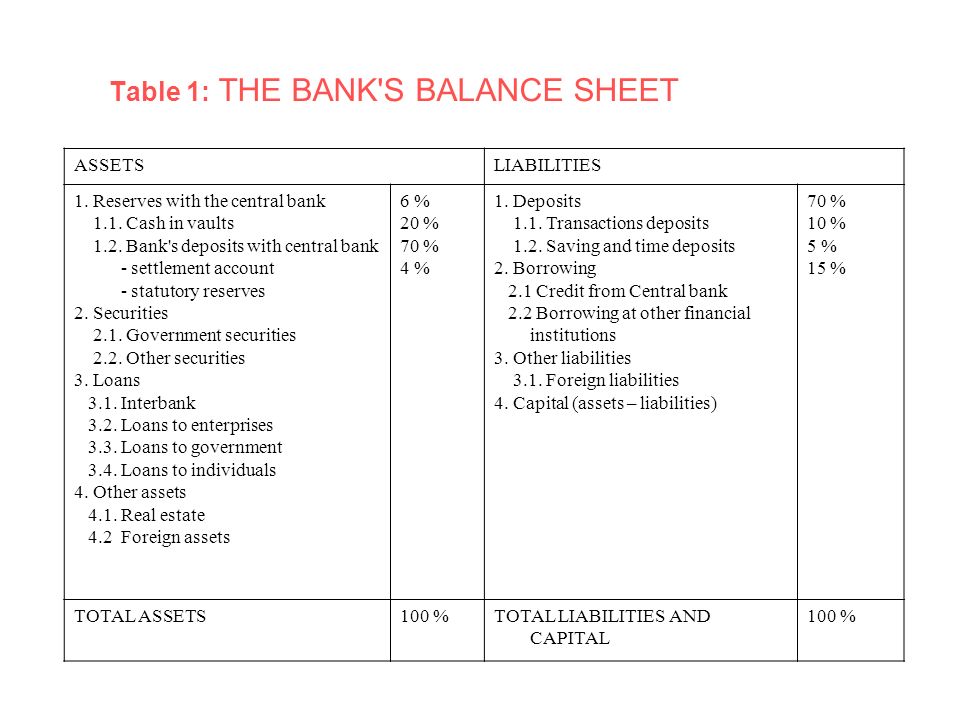

Bank balance sheet assets and liabilities. A balance sheet is an accounting tool that lists assets and liabilities. An asset is something of value that is owned and can be used to produce something. For example the cash you own can be used to pay your tuition. Money banking bank balance sheet.

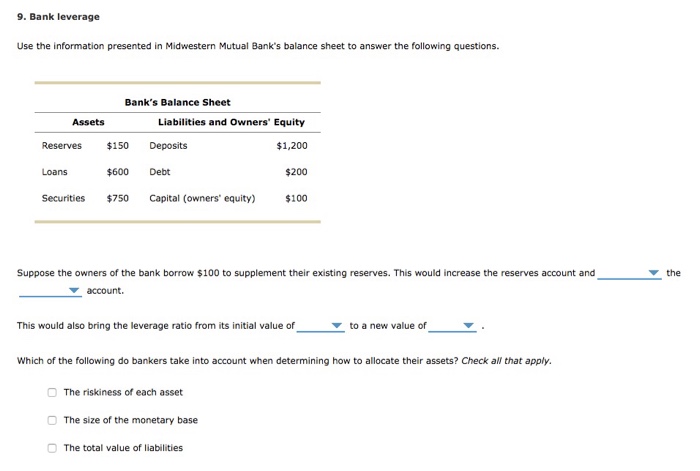

Assets liabilities and bank capital. A balance sheet gives an overview of your business assets and liabilities. Now that weve looked at a banks assets we also need to understand the other side of the balance sheet its liabilities which are how a bank finances its assets. Assets are everything your business owns.

Whats left is the book value of your company known as capital equity depending on whether you operate as a sole proprietor or as a corporation with stockholders. Balance sheet analysis is the analysis of the assets liabilities and owners capital of the company by the different stakeholders for the purpose of getting the correct financial position of the business at a particular point in time. A liability is a debt or something you owe. A balance sheet aka statement of condition statement of financial position is a financial report that shows the value of a companys assets liabilities and owners equity on a specific date usually at the end of an accounting period such as a quarter or a yearan asset is anything that can be sold for value.

A home provides shelter and can be rented out to generate income. Many people borrow money to buy homes.